Greater Toronto Real Estate Market Report

August 2022

There were 5,627 home sales reported through the Toronto Regional Real Estate Board’s (TRREB) MLS® System in August 2022, representing a year-over-year dip of 34.2 per cent 3 a lesser annual rate of decline compared to the previous four months. The August sales result also represented a month-over-month increase compared to July.

Sales represented a higher share of new listings compared to the previous three months. If this trend continues, it could indicate some support for selling prices in the months ahead. On a year-over-year basis, the MLS® Home Price Index (HPI) was up by 8.9 per cent and the average selling price for all home types combined was up by 0.9 per cent to $1,079,500. The average selling price was also up slightly month-over-month, while the HPI Composite was lower compared to July. Monthly growth in the average price versus a dip in the HPI Composite suggests a greater share of more expensive home types sold in August.

While higher borrowing costs have impacted home purchase decisions, existing homeowners nearing mortgage renewal are also facing higher costs. There is room for the federal government to provide for greater housing affordability for existing homeowners by removing the stress test when existing mortgages are switched to a new lender, allowing for greater competition in the mortgage market. Further, allowing for longer amortization periods on mortgage renewals would assist current homeowners in an inflationary environment where everyday costs have risen dramatically,= said TRREB President Kevin Crigger.

The Office of the Superintendent of Financial Institutions (OSFI) should weigh in on whether the current stress test remains applicable. Is it reasonable to test home buyers at two percentage points above the current elevated rates, or should a more flexible test be applied that follows the interest rate cycle? In addition, OSFI should consider removing the stress test for existing mortgage holders who want to shop for the best possible rate at renewal rather than forcing them to stay with their existing lender to avoid the stress test. This is especially the case when no additional funds are being requested,= said TRREB CEO John DiMichele.

There are other issues beyond borrowing costs impacting housing affordability in the Greater Golden Horseshoe. The ability to bring on more supply is the longer-term challenge. However, we are moving in the right direction on this front. The strong mayor proposal from the province coupled with the recent commitment from Toronto Mayor John Tory to expand ownership and rental housing options are examples of this. TRREB looks forward to hearing additional initiatives from candidates vying for office in the upcoming municipal elections,= said TRREB Chief Market Analyst Jason Mercer.

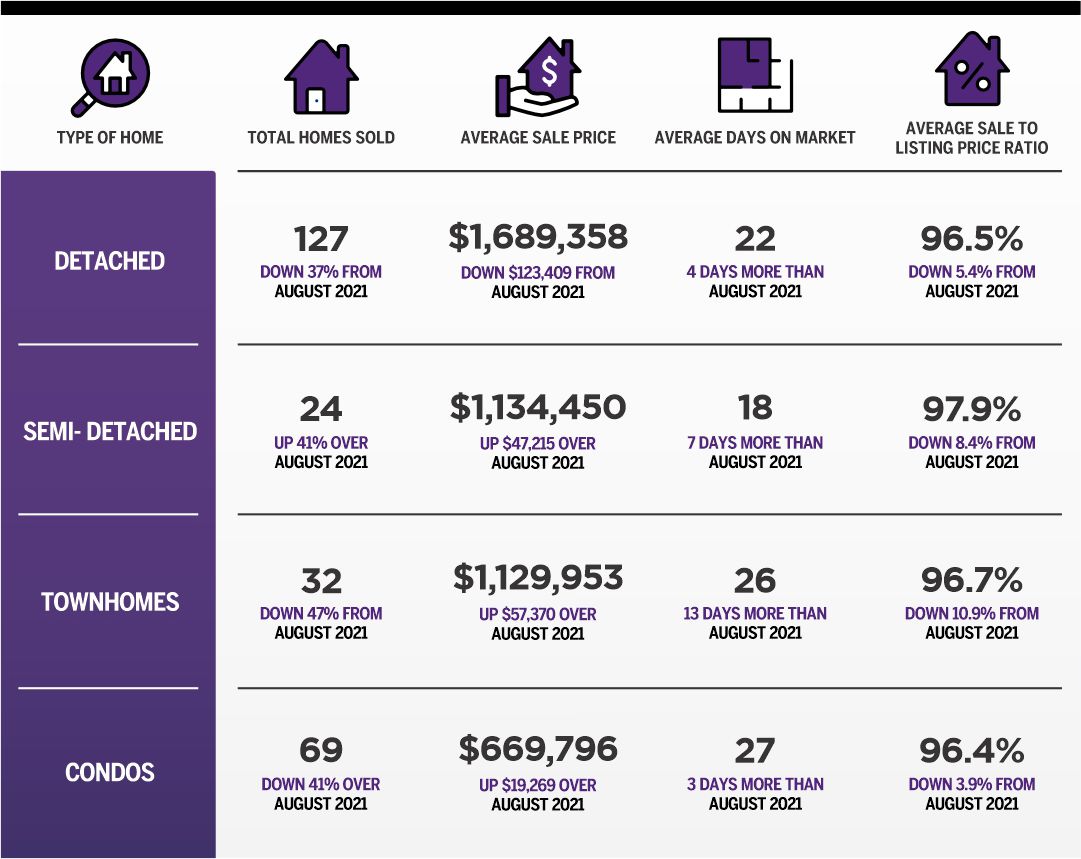

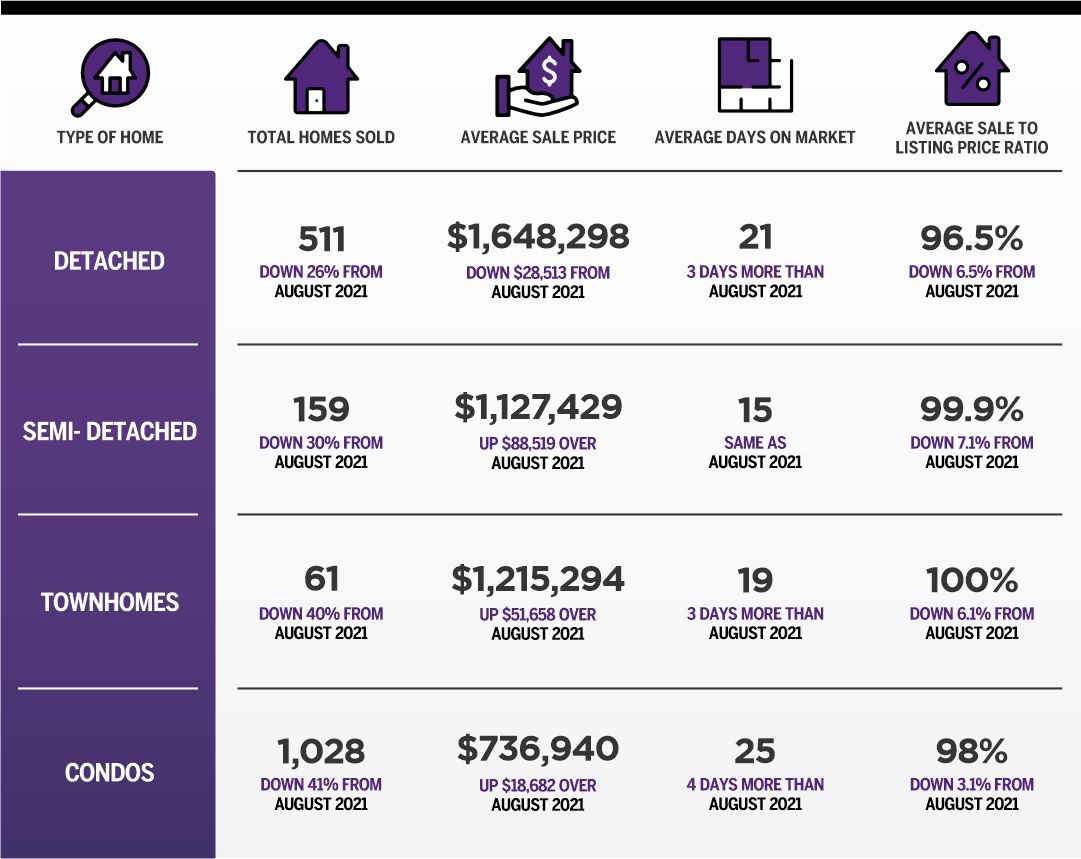

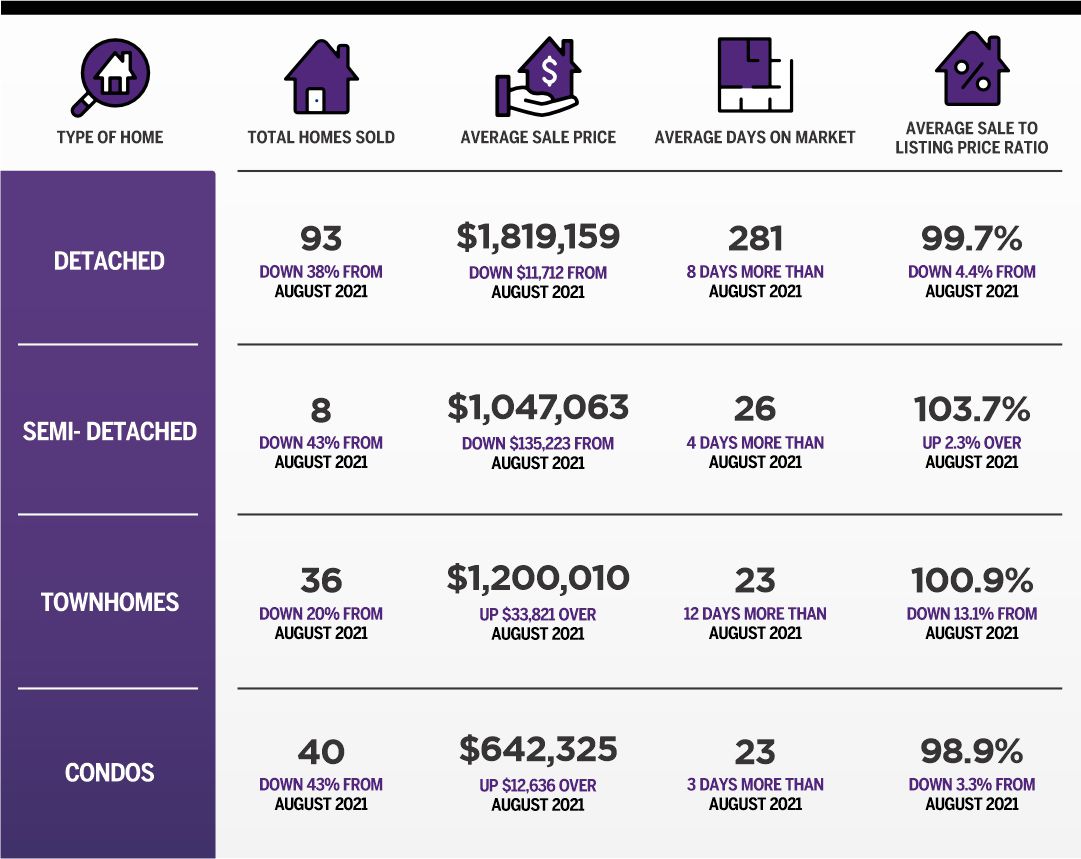

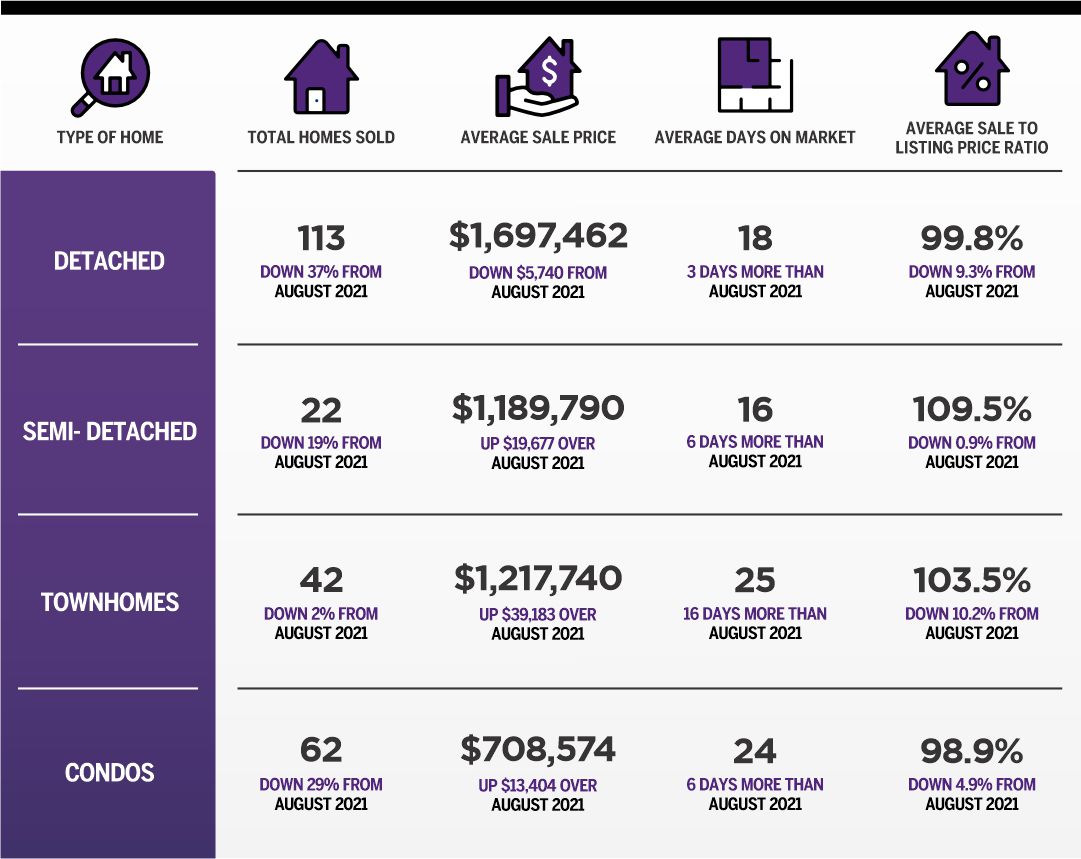

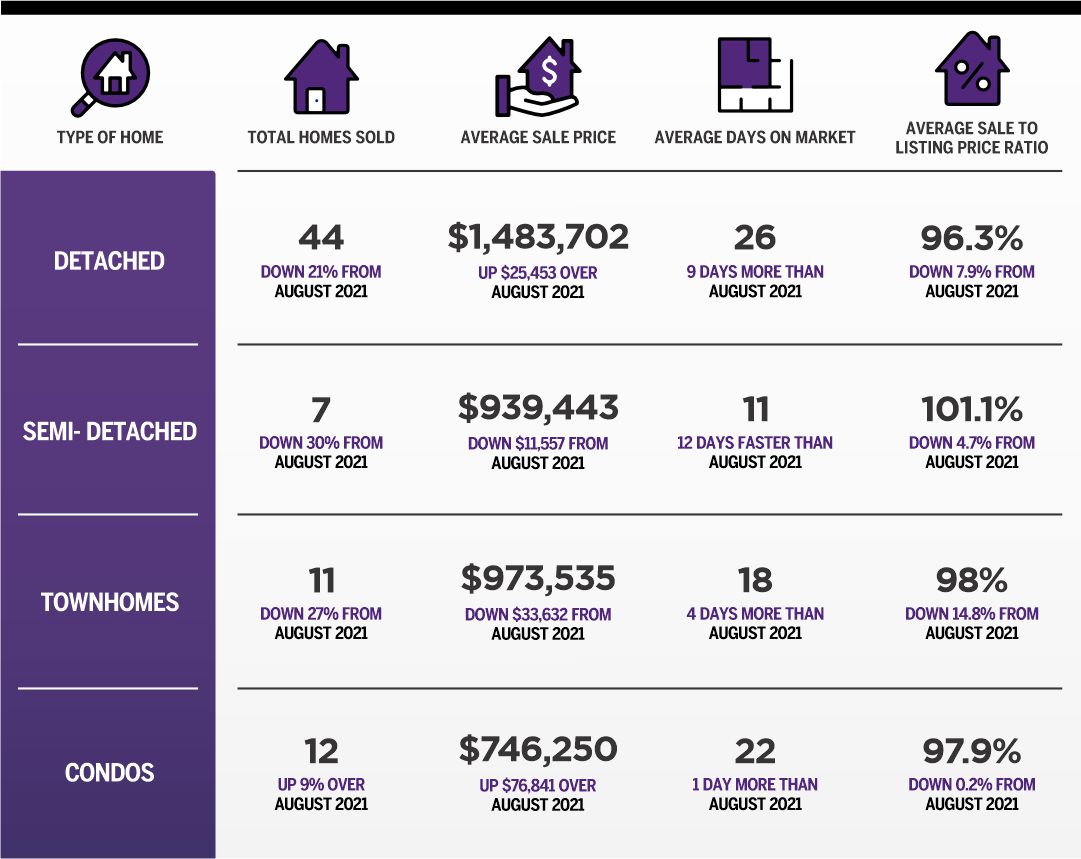

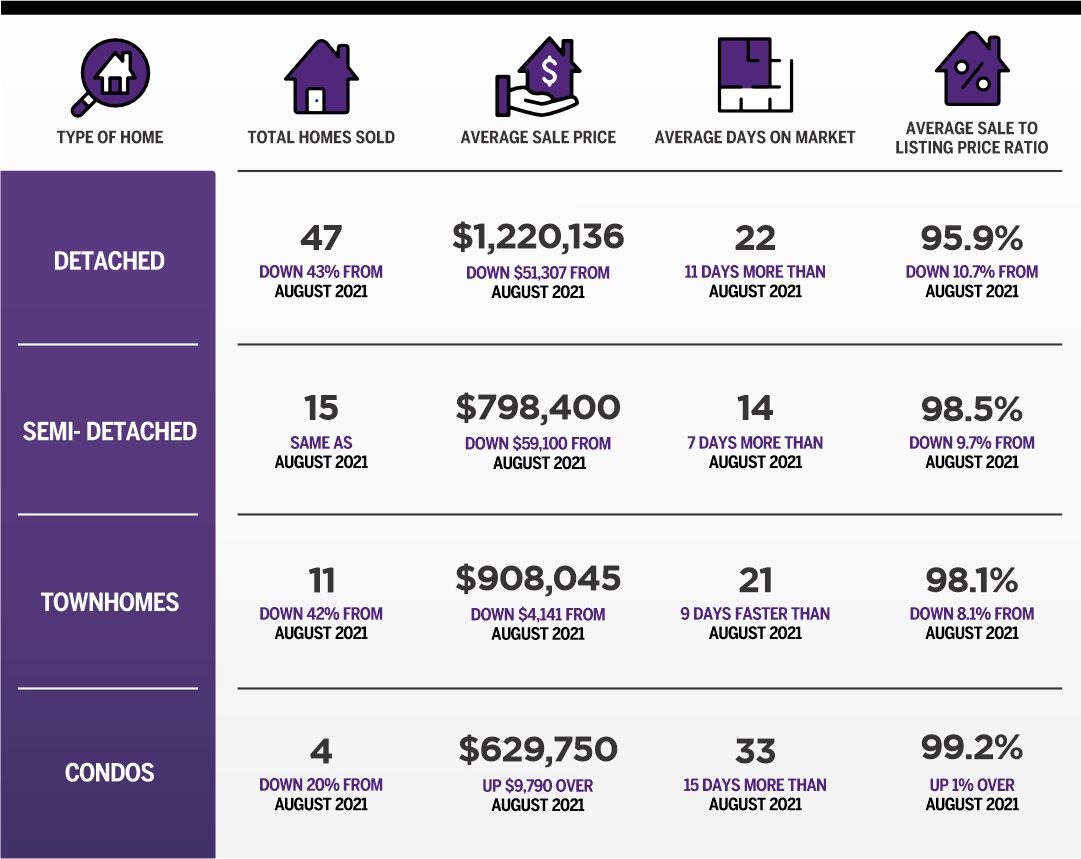

Take a look at the detailed numbers below. If you have any questions about the market, get in touch. We’re here to help guide you through the unique challenges and opportunities presented by this market.

If considering buying or selling give us a call. Our advanced marketing techniques, free staging, available buyers and uncompromising approach yield consistently excellent results.

How Can We Help You?

Whether you’re looking for your first home, your dream home or would like to sell, we’d love to work with you! Fill out the form below and a member of our team will be in touch within 24 hours to discuss your real estate needs.

Dave Elfassy, Broker

PHONE: 416.899.1199 | EMAIL: [email protected]

Sutt on Group-Admiral Realty Inc., Brokerage

on Group-Admiral Realty Inc., Brokerage

1206 Centre Street

Thornhill, ON

L4J 3M9

Read Our Reviews!

What does it mean to be 1NVALUABLE? It means we’ve got your back. We understand the trust that you’ve placed in us. That’s why we’ll do everything we can to protect your interests–fiercely and without compromise. We’ll work tirelessly to deliver the best possible outcome for you and your family, because we understand what “home” means to you.