Great News for GTA Homebuyers: Bank of Canada Cuts Interest Rate to 2.5%

August 2025

Bottom Line: The Bank of Canada’s September 17th rate cut to 2.5% brings exciting relief for homebuyers and existing mortgage holders across the Greater Toronto Area, with even more positive changes likely on the horizon!

September 17, 2025, marked a fantastic day for the Greater Toronto Area real estate market! The Bank of Canada delivered its first interest rate cut since March, reducing the overnight rate by 25 basis points to 2.5%. This welcome decision by Governor Tiff Macklem and the Governing Council responds to positive economic developments, including controlled inflation and strategic policy adjustments that are setting the stage for renewed market activity.

Why This Rate Cut is Great News

This rate cut comes at exactly the right time, with several encouraging economic indicators aligning perfectly for potential homebuyers and current homeowners throughout the GTA.

Smart Economic Management: The federal government’s removal of retaliatory tariffs against the U.S. has reduced inflationary pressures, giving the Bank of Canada the flexibility to support homebuyers with lower rates. Governor Macklem noted this strategic move has helped create “less upside risk” to future inflation.

Inflation Under Control: With overall inflation sitting comfortably at 1.9% and core measures stabilizing, the Bank has gained valuable room to help stimulate the economy without compromising price stability. This is exactly what homebuyers have been hoping for!

Immediate Savings: The August labour market data, while showing some cooling, actually supports the case for continued rate relief that will benefit families looking to buy or refinance their homes.

Your Mortgage Just Got More Affordable!

The rate cut delivers immediate, tangible benefits for families across the GTA. TD Bank, BMO, CIBC and RBC all reduced their prime rates by 25 basis points to 4.70% the same afternoon, passing the savings directly to consumers.

Here’s what this means for your wallet: if you have a variable-rate mortgage, you could see your five-year variable rate drop from 3.95% to 3.70%. That translates into amazing monthly savings of $84, or over $1,000 per year! For families managing household budgets, this relief couldn’t come at a better time.

These savings provide meaningful support to homeowners who’ve been navigating higher borrowing costs, and create exciting new opportunities for first-time buyers who’ve been waiting for the right moment to enter the market.

Exciting Opportunities in the Greater Toronto Area Market

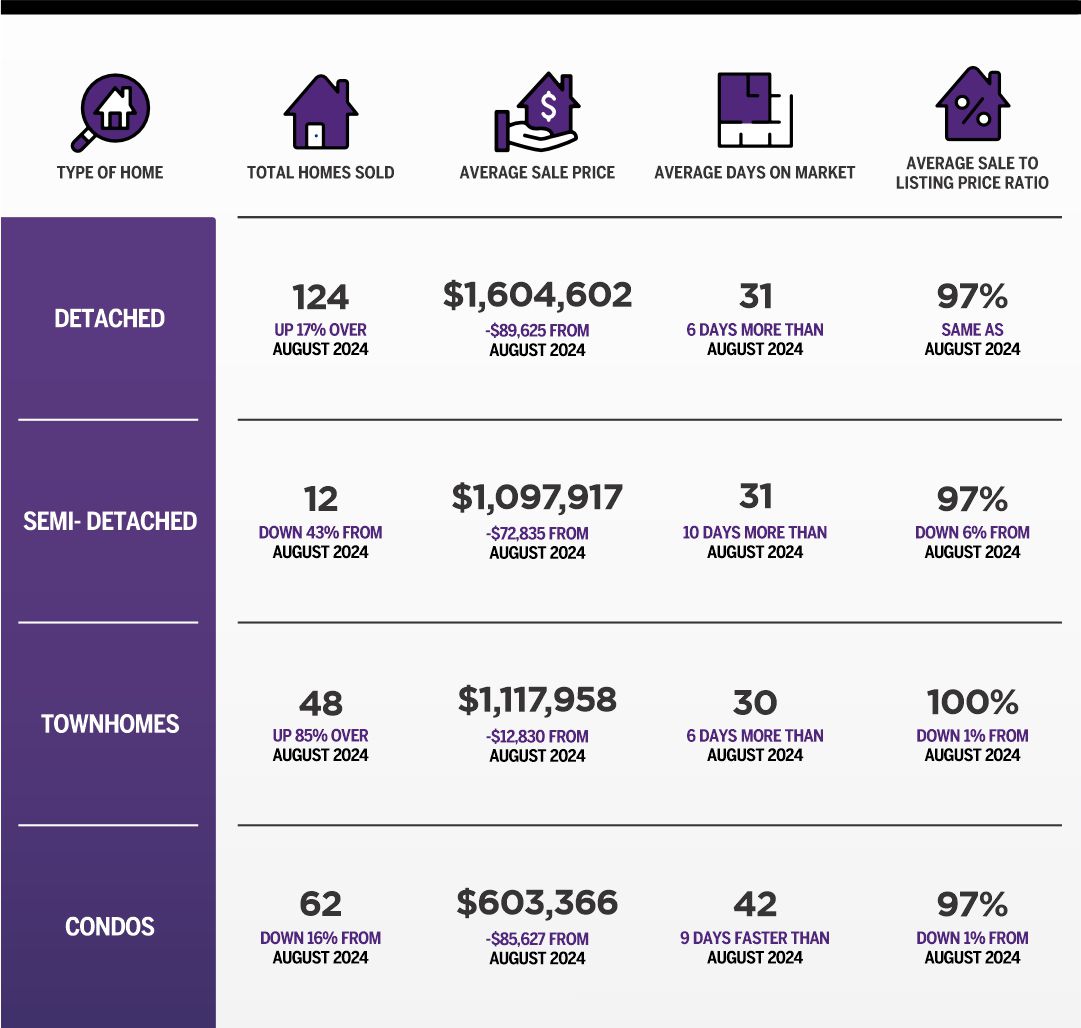

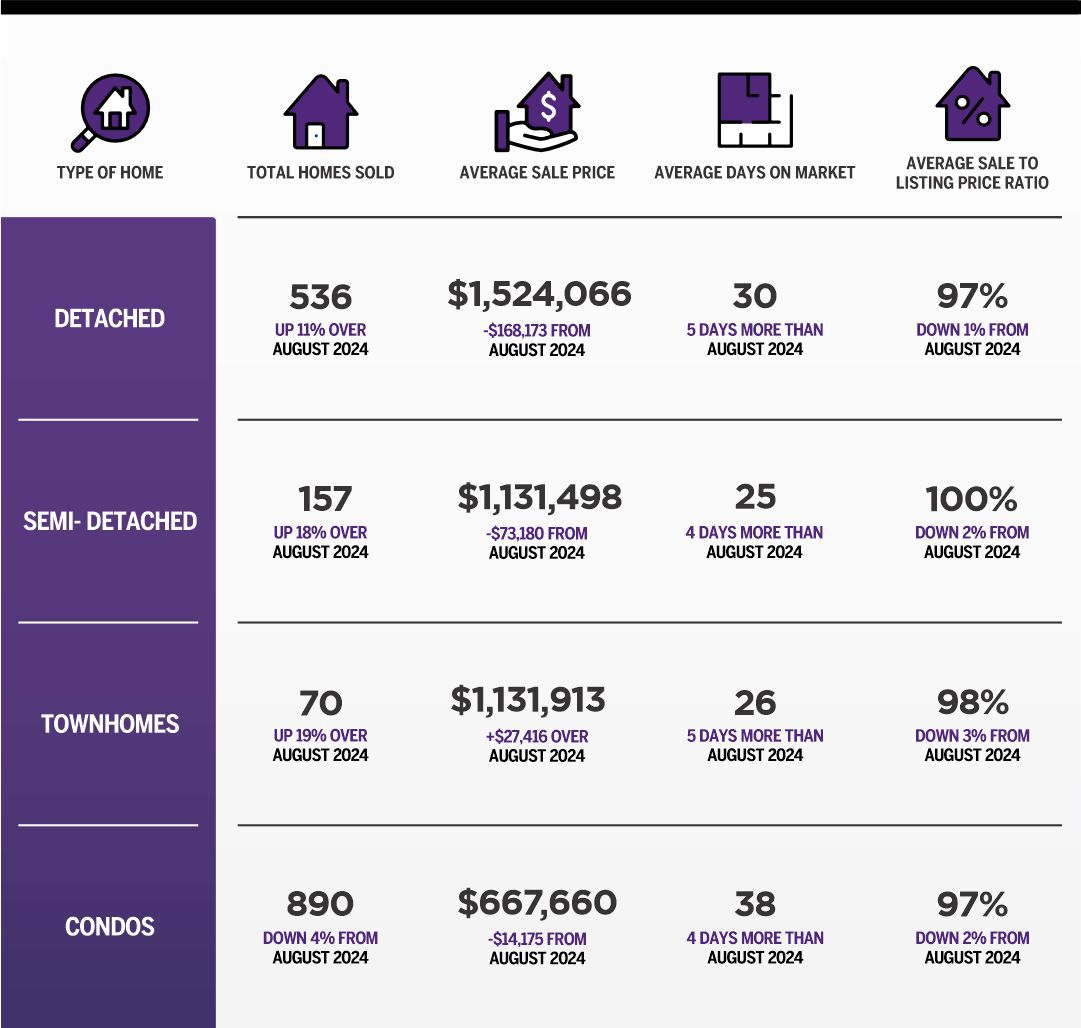

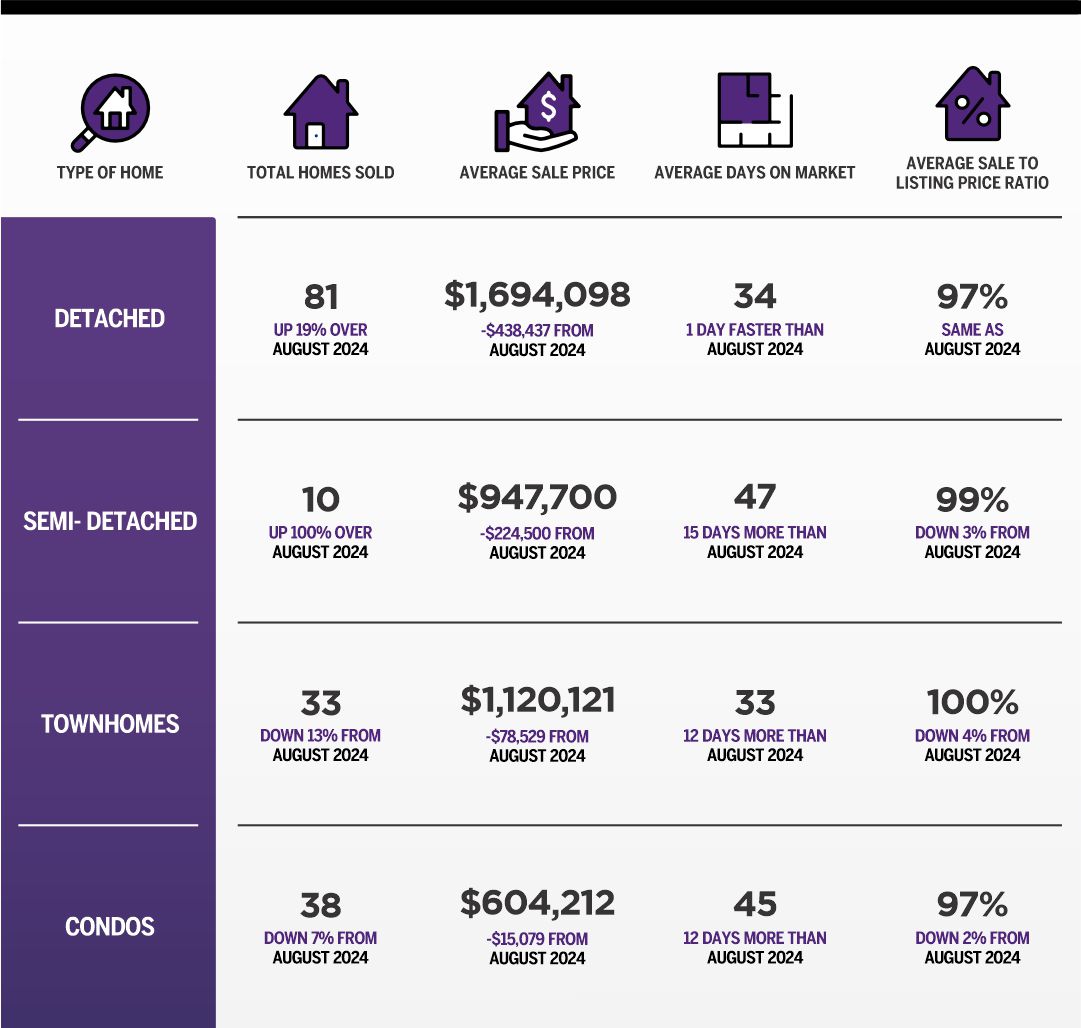

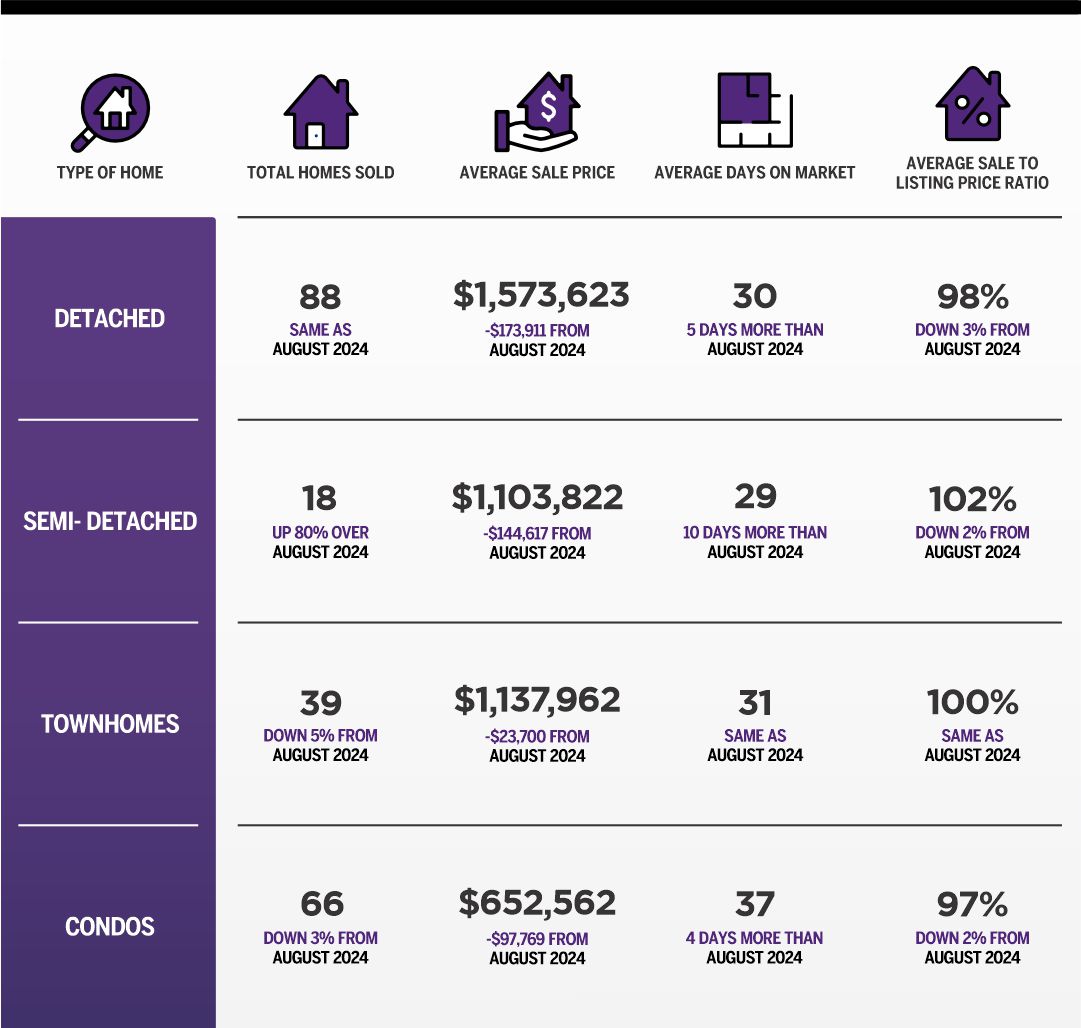

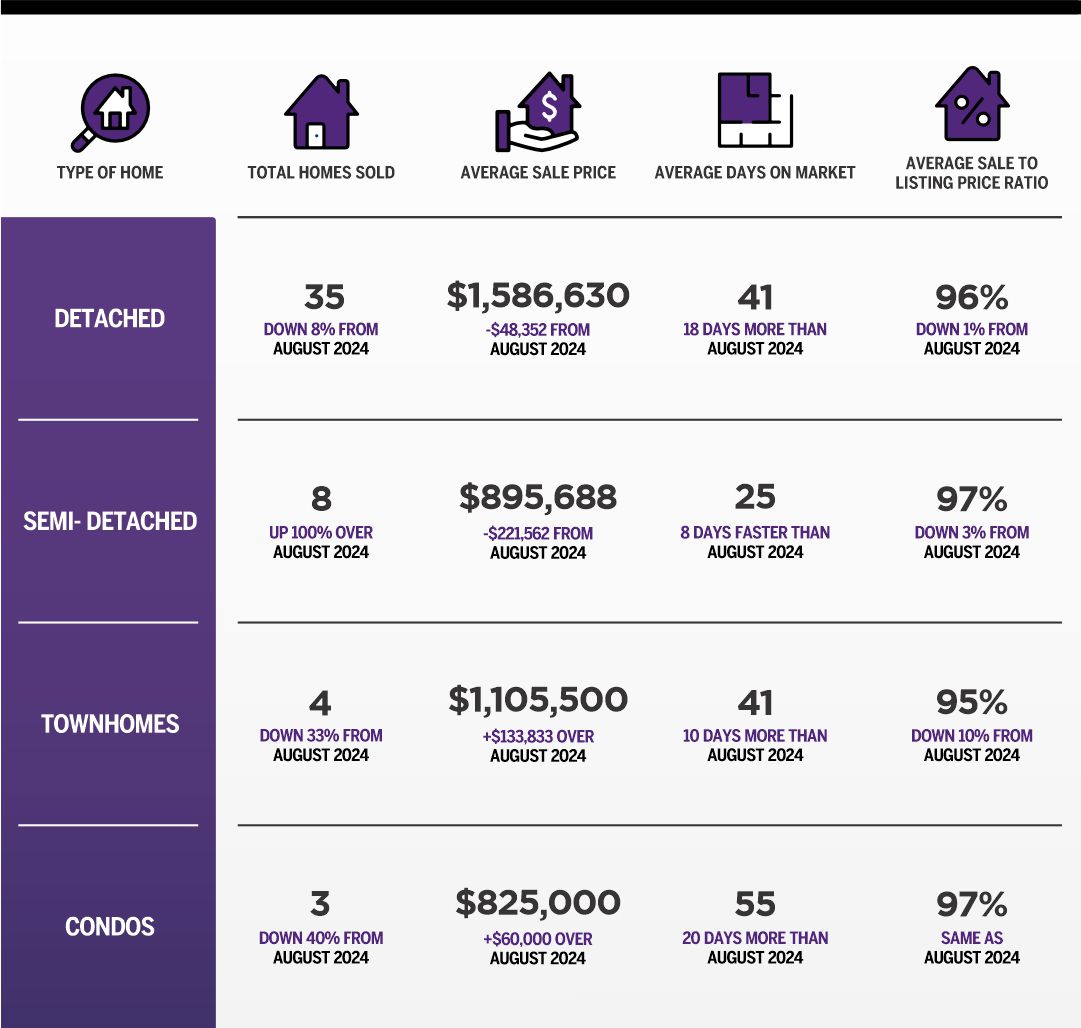

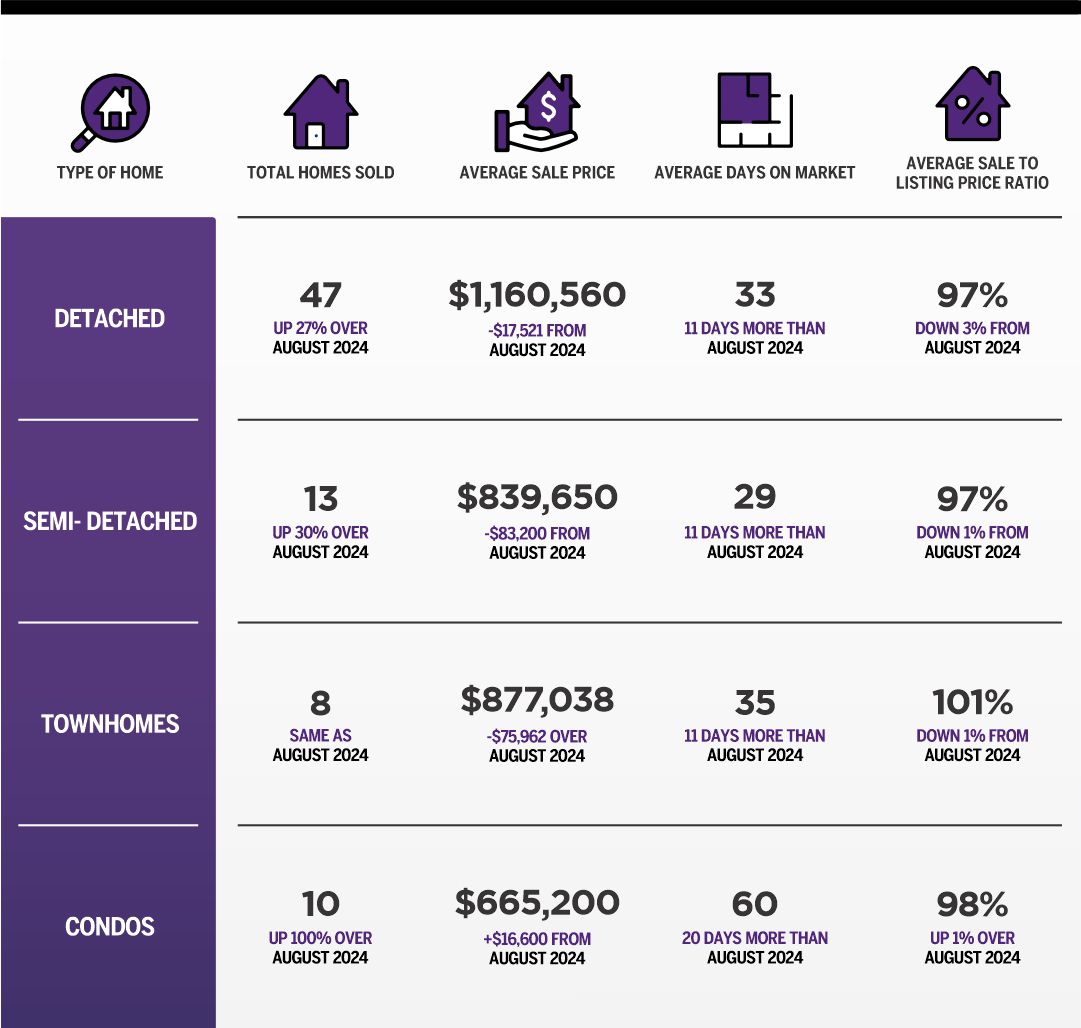

The latest market data from the Greater Toronto Area reveals a market that’s perfectly positioned to benefit from these lower borrowing costs, with plenty of great opportunities for buyers across all communities from Vaughan to Markham, Mississauga to Durham Region.

Growing Market Activity: GTA REALTORS® reported 5,211 home sales in August 2025 – up 2.3% compared to August 2024. Even better news? New listings jumped by an impressive 9.4% year-over-year to 14,038, giving buyers fantastic choice across all price ranges and property types.

Better Value for Buyers: The average selling price of $1,022,143 represents a 5.2% year-over-year adjustment that, combined with lower interest rates, is creating the best affordability we’ve seen in quite some time. Buyers are benefiting from both improved pricing and reduced borrowing costs – a win-win situation!

Well-Supplied Market: The increased inventory means buyers can take their time finding the perfect home without feeling rushed, whether they’re looking for a condo in the urban core, a family home in the suburbs, or something in between.

Even More Good News Coming

Industry experts are optimistic about what lies ahead, and the signals are all pointing to continued positive developments for the GTA real estate market.

Additional Rate Relief Expected: “With the economy slowing and inflation under control, additional interest rate cuts by the Bank of Canada could help offset the impact of tariffs. Greater affordability would not only support more home sales but also generate significant economic spin-off benefits,” said TRREB President Elechia Barry-Sproule.

Expert Optimism: Most economists not only expected this rate cut but believe more relief is coming. “I think it’s reasonable to expect some extra rate-cutting,” noted Eric Lascelles, chief economist at RBC Global Asset Management. This suggests we’re at the beginning of a positive trend for borrowers.

Perfect Timing: The Bank’s next decision comes October 29, and the groundwork is already being laid for continued support for families looking to buy homes across the Greater Toronto Area.

Housing Market Leading Economic Recovery

Real estate has historically been a key driver of economic recovery, and the GTA is well-positioned to lead the way once again.

“In the short term, spurring consumer spending on large ticket items like housing could lead recovery, as it has in previous economic cycles,” explained TRREB Chief Executive Officer John DiMichele. This means that families who choose to buy now aren’t just making a great personal decision – they’re also contributing to broader economic strength.

Your Next Steps in This Evolving Market

The September rate cut represents the start of what many economists expect to be a series of improvements designed to support families and the economy. For the Greater Toronto Area’s real estate market, this is fantastic news that opens up new possibilities for buyers and sellers alike.

Great Opportunities for:

- Variable rate mortgage holders enjoying immediate payment relief

- First-time buyers benefiting from improved affordability and choice

- Move-up buyers taking advantage of a well-supplied market with great selection

- Investors positioning themselves ahead of anticipated market recovery

The combination of controlled inflation, supportive monetary policy, and strategic economic management creates an excellent environment for real estate decisions. For the Greater Toronto Area’s diverse communities, the September rate cut provides exciting opportunities, with more positive developments likely on the horizon.

Ready to Take Advantage of These Great Market Conditions?

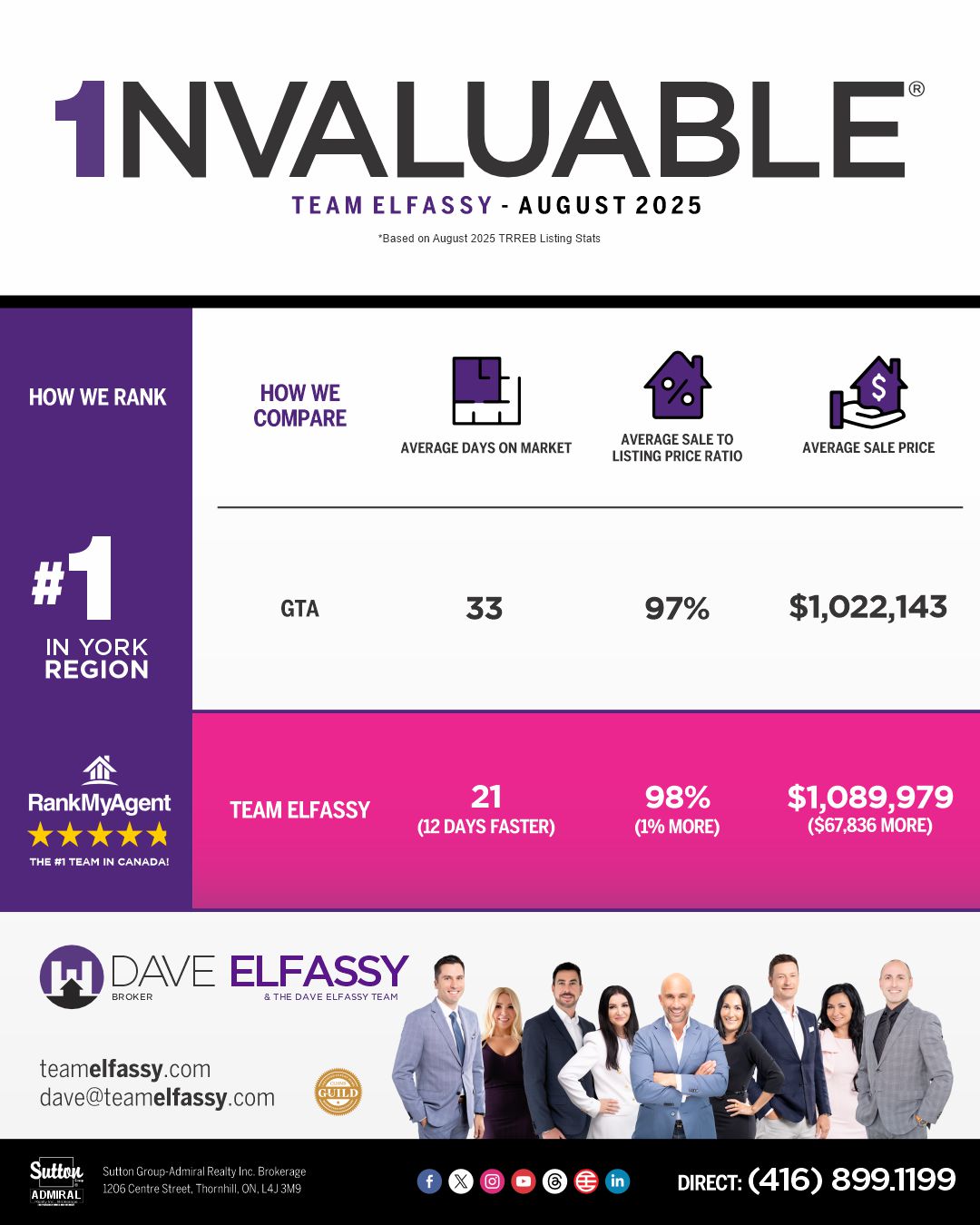

At Team Elfassy, we’re here to help you navigate these exciting opportunities in the Greater Toronto Area market. Whether you’re a first-time buyer benefiting from improved affordability, a current homeowner looking to make a move, or an investor seeking the perfect opportunity, our 1NVALUABLE team understands the local market dynamics across all GTA communities.

Why Choose Team Elfassy?

- Deep expertise in GTA markets from Vaughan to all surrounding areas

- Personalized service tailored to your unique needs and timeline

- Industry-leading 1% listing commission that puts more money back in your pocket

- Proven track record of successful transactions in all market conditions

Ready to explore what these positive market changes mean for your real estate goals? Contact us today – we’d love to show you how these exciting developments can work in your favour!

Canada’s #1 Real Estate Team

#1 Real Estate Team in Canada – Team Elfassy 2025 We're honored to announce that Team Elfassy has retained the #1 real estate team in Canada ranking on Rank My Agent for 2025! With

$205 Million Sold In 2025

$205 Million Sold In 2025 The final numbers for 2025 are in - and they tell a meaningful story. In one of the most challenging real estate markets in decades, Team Elfassy sold over

October 2025 Greater Toronto Real Estate Market Report

GTA Real Estate Market Report October 2025 We know keeping up with the real estate market can feel overwhelming, so we wanted to break down what's actually happening out there right now. Grab a

How Can We Help You?

Whether you’re looking for your first home, your dream home or would like to sell, we’d love to work with you! Fill out the form below and a member of our team will be in touch within 24 hours to discuss your real estate needs.

Dave Elfassy, Broker

PHONE: 416.899.1199 | EMAIL: [email protected]

Sutt on Group-Admiral Realty Inc., Brokerage

on Group-Admiral Realty Inc., Brokerage

1206 Centre Street

Thornhill, ON

L4J 3M9

Read Our Reviews!

What does it mean to be 1NVALUABLE? It means we’ve got your back. We understand the trust that you’ve placed in us. That’s why we’ll do everything we can to protect your interests–fiercely and without compromise. We’ll work tirelessly to deliver the best possible outcome for you and your family, because we understand what “home” means to you.