Greater Toronto Real Estate Market Report

July 2022

There were 4,912 home sales reported through the Toronto Regional Real Estate Board (TRREB) MLS® System in July 2022 – down by 47 per cent compared to July 2021. Following the regular seasonal trend, sales were also down compared to June. New listings also declined on a year-over-year basis in July, albeit down by a more moderate four per cent. The expectation is that the trend for new listings will continue to follow the trend for sales, as we move through the second half of 2022 and into 2023.

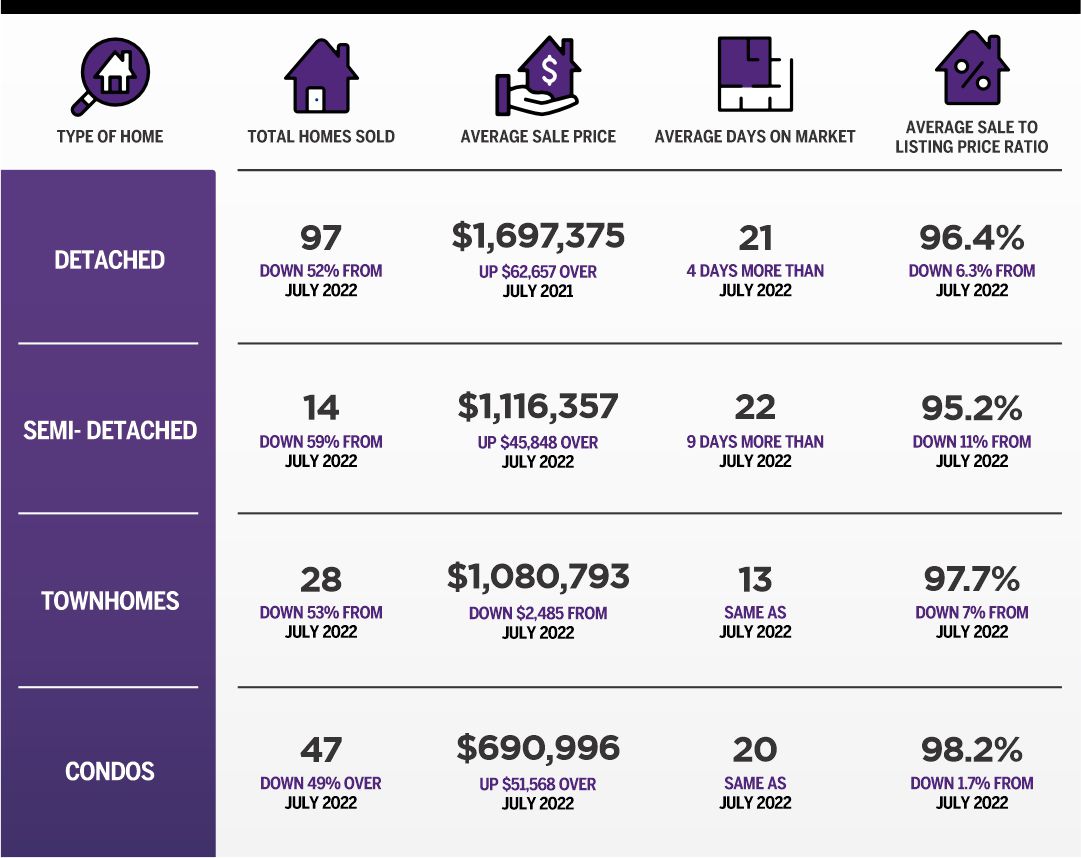

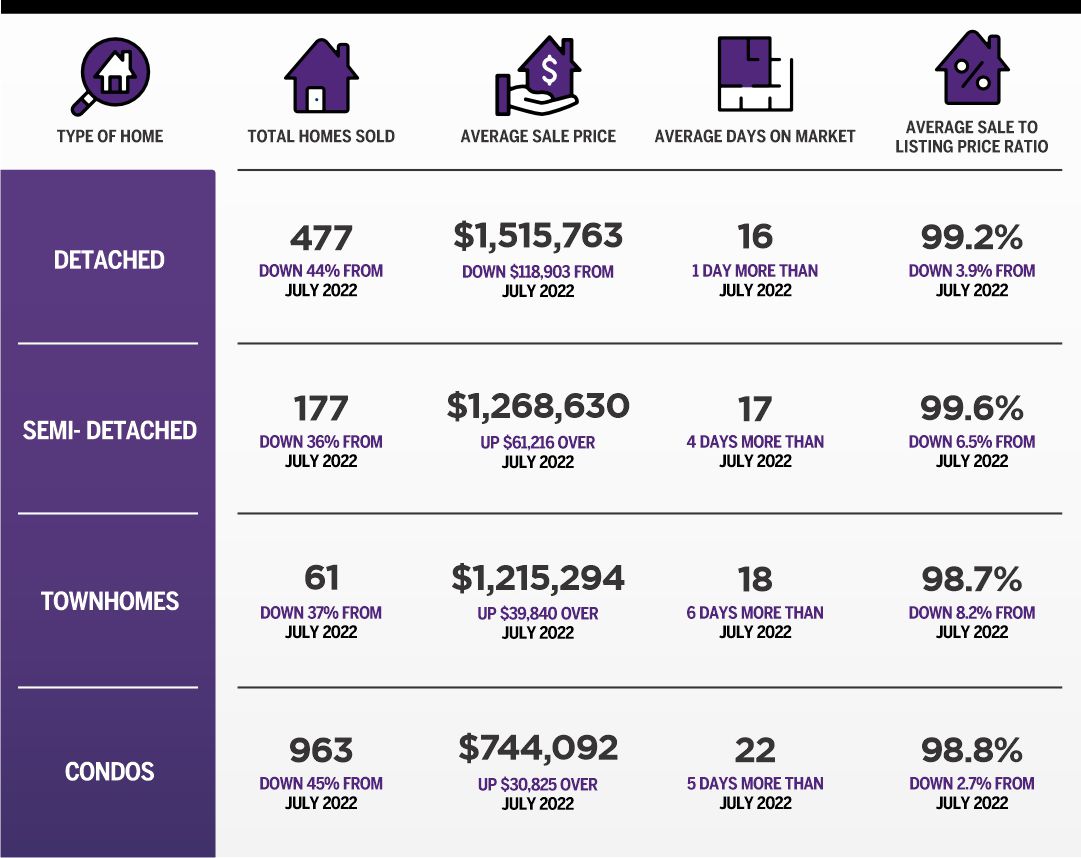

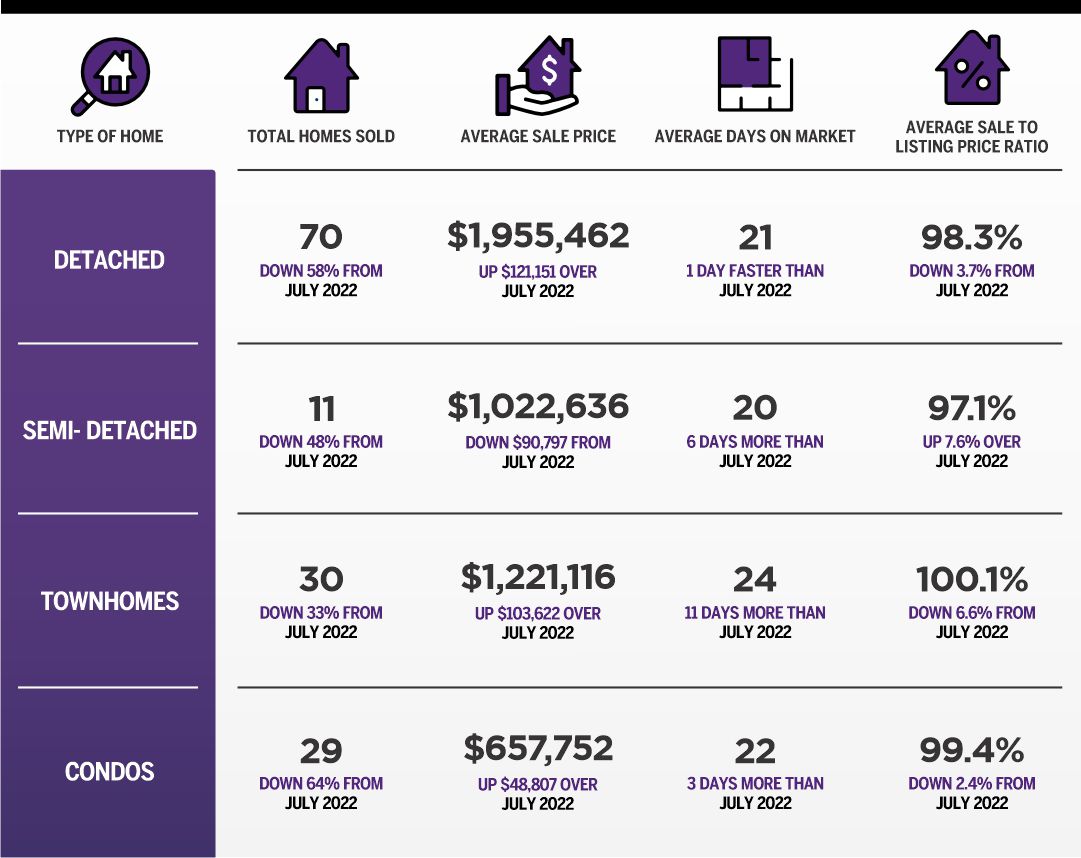

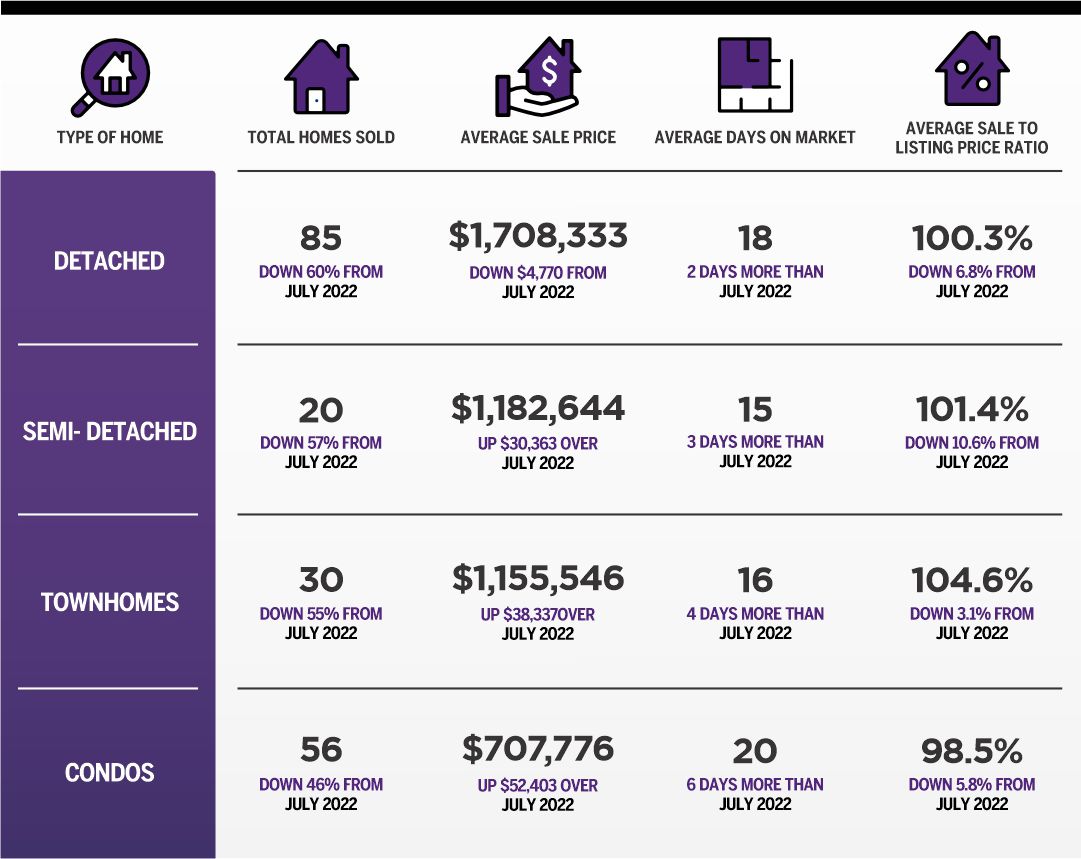

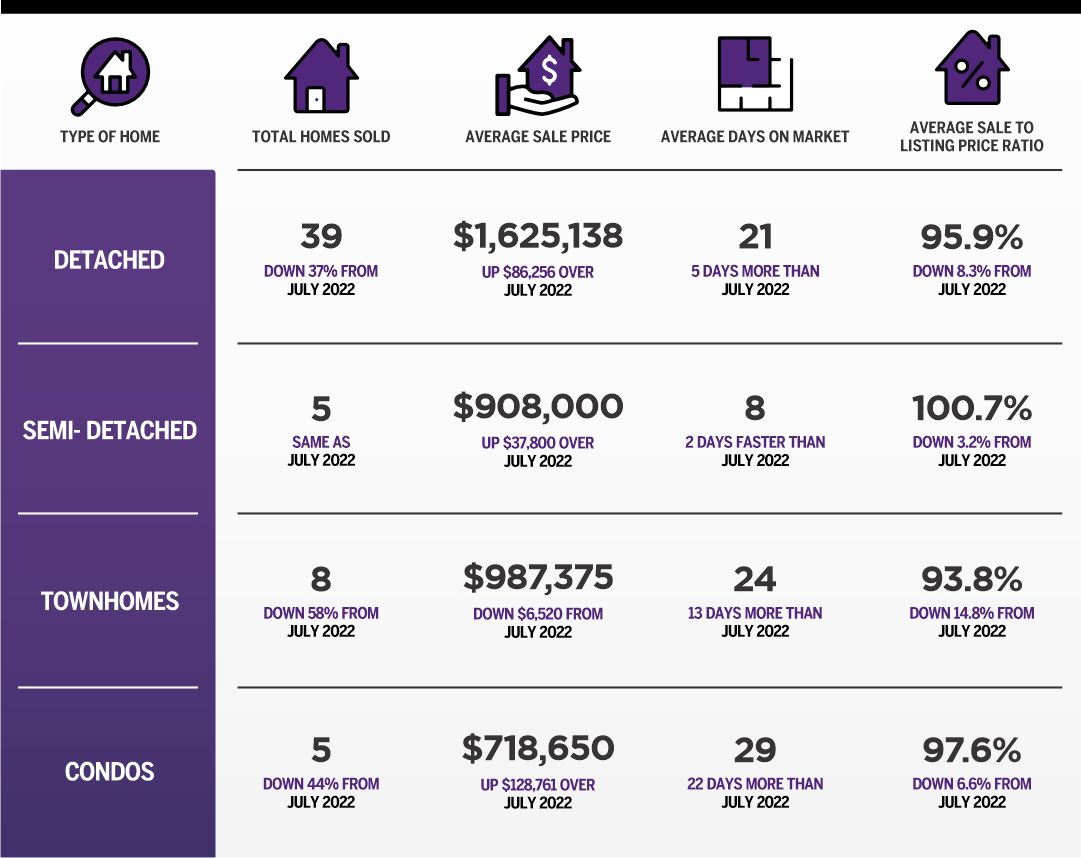

Market conditions remained much more balanced in July 2022 compared to a year earlier. As buyers continued to benefit from more choice, the annual rate of price growth has moderated. The MLS® Home Price Index (HPI) Composite Benchmark was up by 12.9 per cent year-over-year. The average selling price was up by 1.2 per cent compared to July 2021 to $1,074,754. Less expensive home types, including condo apartments, experienced stronger rates of price growth as more buyers turned to these segments to help mitigate the impact of higher borrowing costs.

“The Greater Toronto Area (GTA) population continues to grow and tight labour market conditions will drive this growth moving forward. Despite more balanced market conditions resulting from rapidly increasing mortgage rates, policymakers must continue to take action to boost housing supply to account for long-term population growth. TRREB has put realistic solutions on the table to address the existing housing affordability challenges. With savings high and the unemployment rate still low, home buyers will eventually account for higher borrowing costs. When they do, we want to have an adequate pipeline of supply in place or market conditions will tighten up again,” said TRREB Chief Market Analyst Jason Mercer.

TRREB is also calling on all levels of government to reassess and clarify policies related to mortgage lending and housing development.

“Many GTA households intend on purchasing a home in the future, but there is currently uncertainty about where the market is headed. Policymakers could help allay some of this uncertainty. As higher borrowing costs impact housing markets, TRREB maintains that the OSFI mortgage stress test should be reviewed in the current environment,” said TRREB CEO John DiMichele.

“With significant increases to lending rates in a short period, there has been a shift in consumer sentiment, not market fundamentals. The federal government has a responsibility to not only maintain confidence in the financial system, but to instill confidence in homeowners that they will be able to stay in their homes despite rising mortgage costs. Longer mortgage amortization periods of up to 40 years on renewals and switches should be explored,” said TRREB President Kevin Crigger.

Take a look at the detailed numbers below. If you have any questions about the market, get in touch. We’re here to help guide you through the unique challenges and opportunities presented by this market.

If considering buying or selling give us a call. Our advanced marketing techniques, free staging, available buyers and uncompromising approach yield consistently excellent results.

Pet Costume Contest 2024

Pet Costume Contest - October 6, 2024 We are absolutely delighted to team up with our Ward 4 Councillor, @chrisainsworthvaughan, for the 3rd Annual Pet Costume Party & Contest! 🐶🐱 Get

#1 Real Estate Team In Canada in 2024!

#1 In Canada With Over 800 Reviews We are thrilled to announce that we've the #1 real estate team in Canada on Rank My Agent, with over 800 reviews and a 4.97/5 rating!

February 2024 Greater Toronto Real Estate Market Report

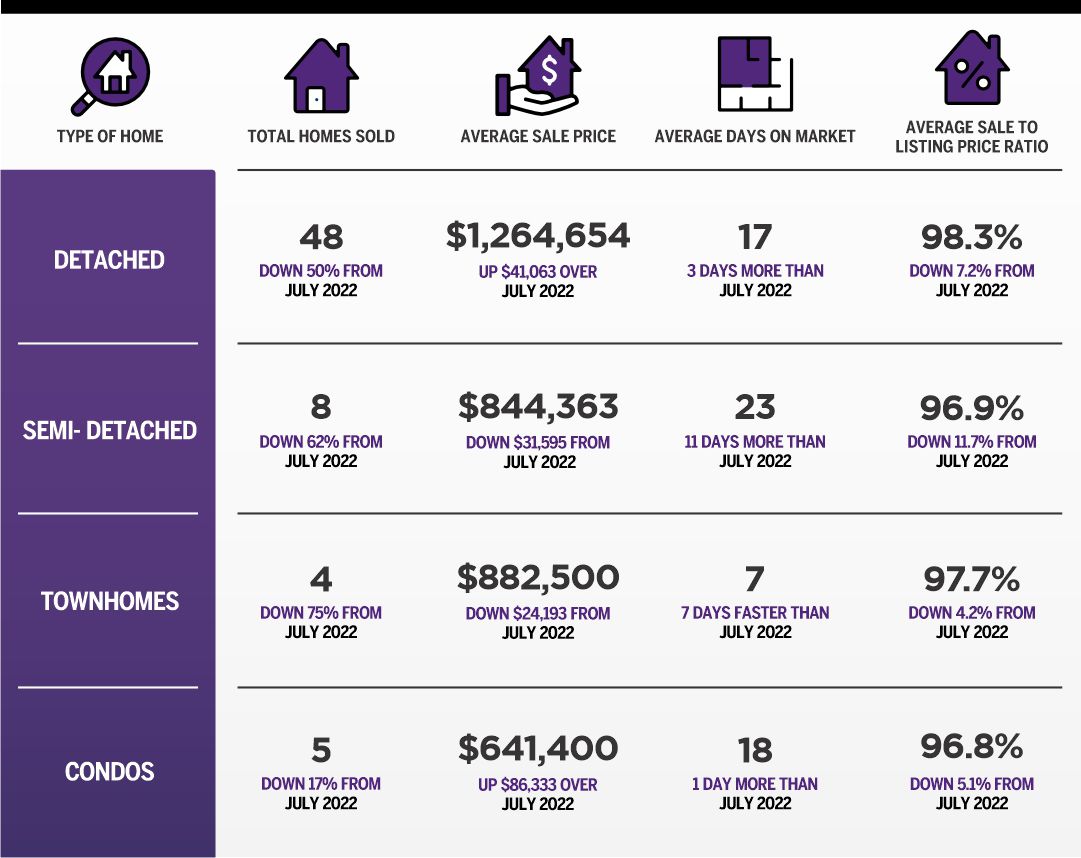

Greater Toronto Real Estate Market Report February 2024 Greater Toronto Area (GTA) home sales and new listings were up on an annual and monthly basis in February 2024. Selling prices also edged upward compared

How Can We Help You?

Whether you’re looking for your first home, your dream home or would like to sell, we’d love to work with you! Fill out the form below and a member of our team will be in touch within 24 hours to discuss your real estate needs.

Dave Elfassy, Broker

PHONE: 416.899.1199 | EMAIL: [email protected]

Sutt on Group-Admiral Realty Inc., Brokerage

on Group-Admiral Realty Inc., Brokerage

1206 Centre Street

Thornhill, ON

L4J 3M9

Read Our Reviews!

What does it mean to be 1NVALUABLE? It means we’ve got your back. We understand the trust that you’ve placed in us. That’s why we’ll do everything we can to protect your interests–fiercely and without compromise. We’ll work tirelessly to deliver the best possible outcome for you and your family, because we understand what “home” means to you.