Greater Toronto Real Estate Market Report

October 2022

Despite the continued housing market transition to a higher borrowing cost environment, the average selling price in the Greater Toronto Area (GTA) found some support near $1.1 million since the late summer. GTA home sales continued to adjust to substantially higher interest rates in October 2022, both on an annual and monthly basis. However, new listings are also down year-over-year and month-over-month. The persistent lack of inventory helps explain why the downward trend in home prices experienced in the spring has flattened over the past three months.

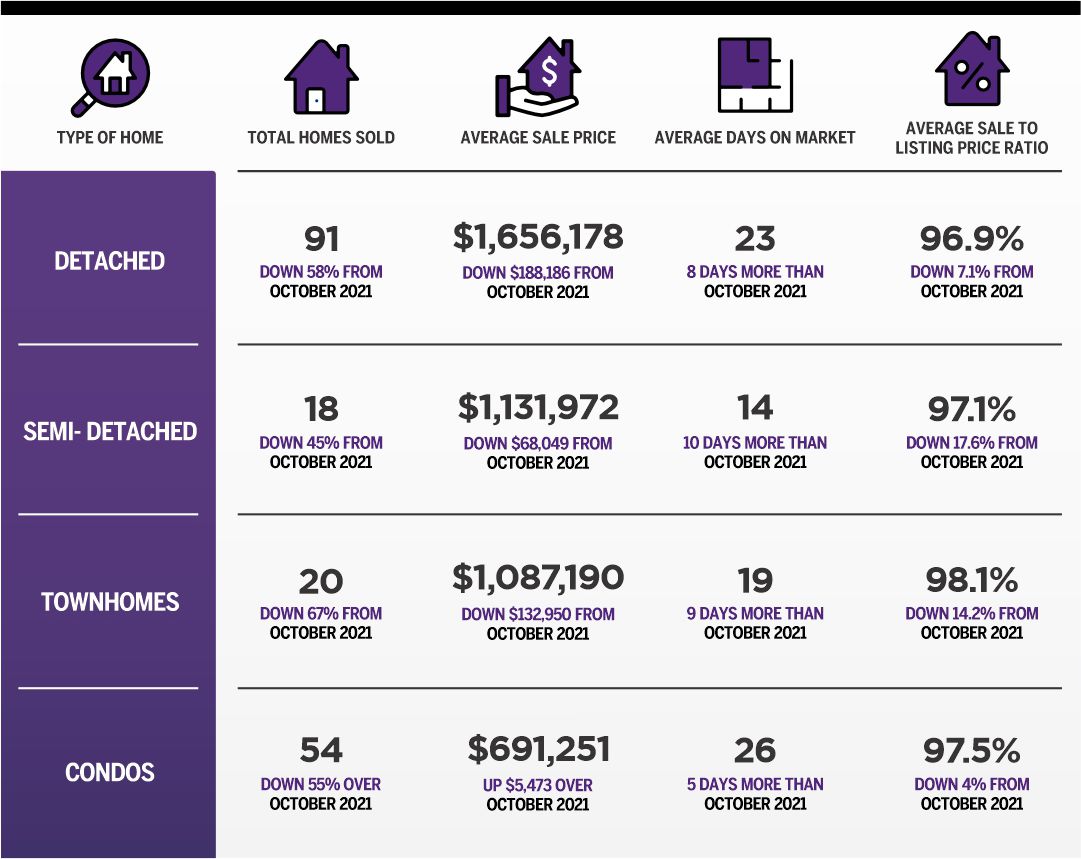

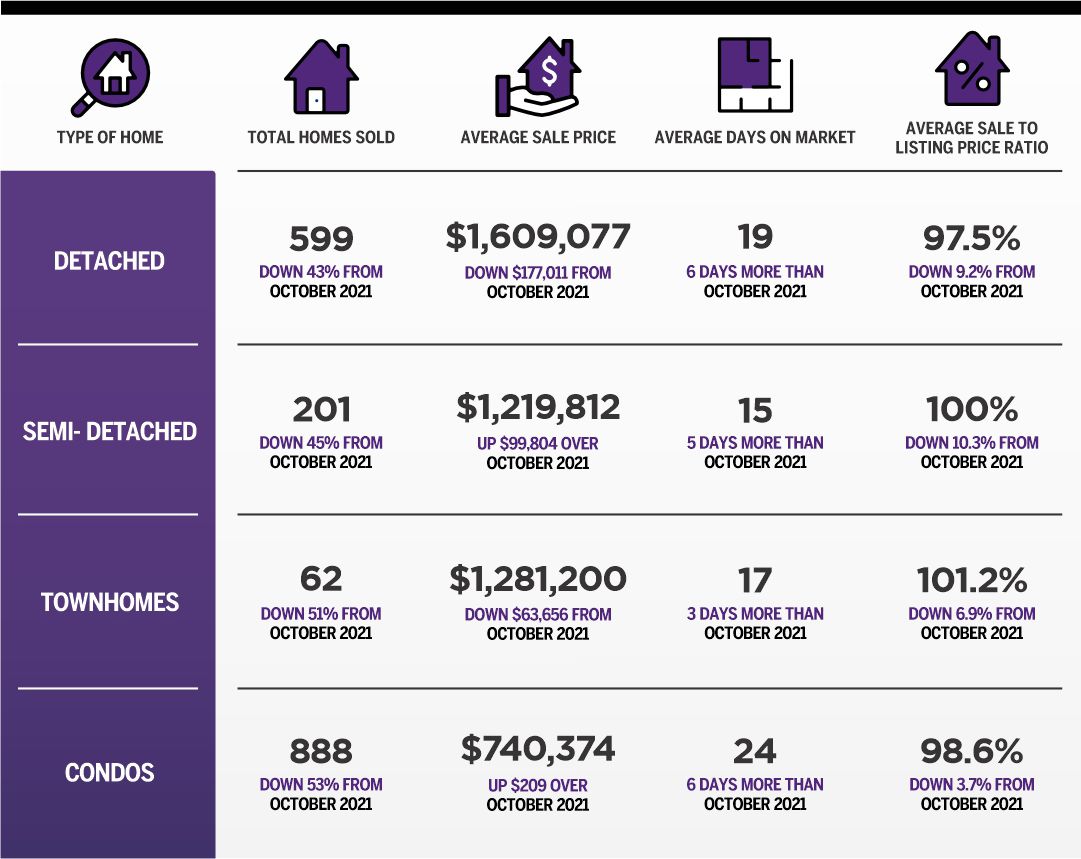

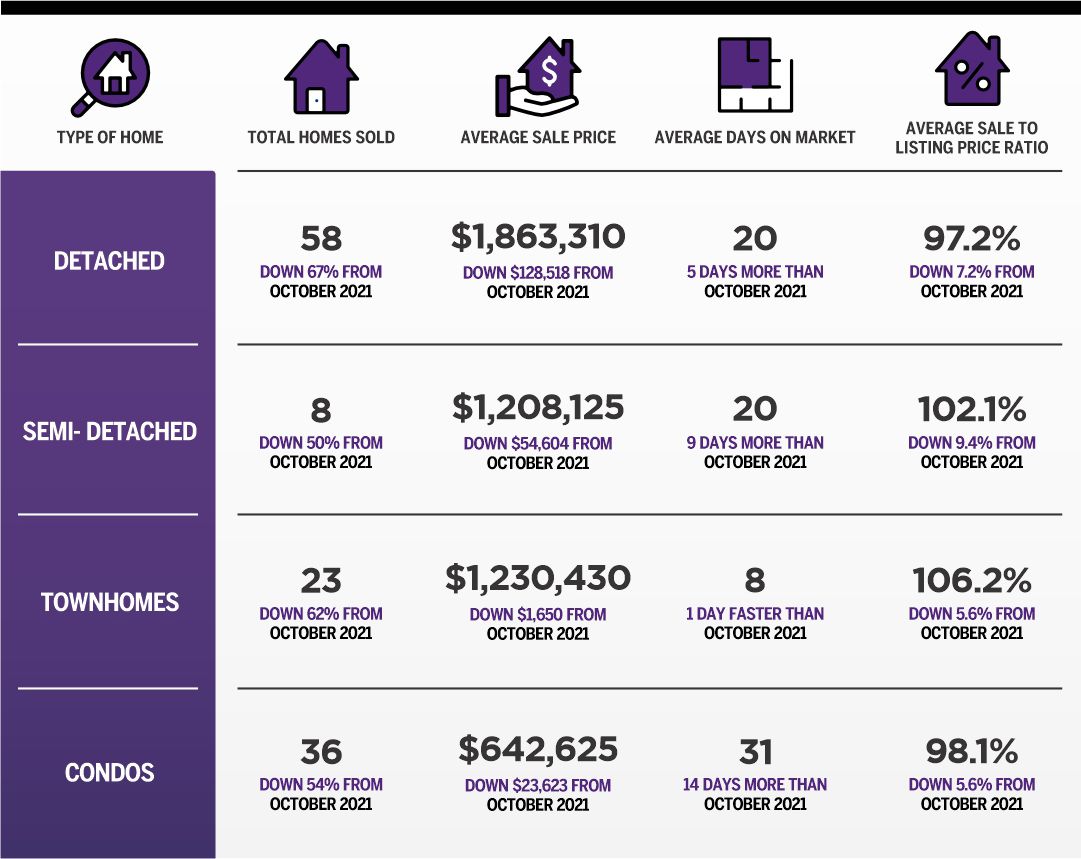

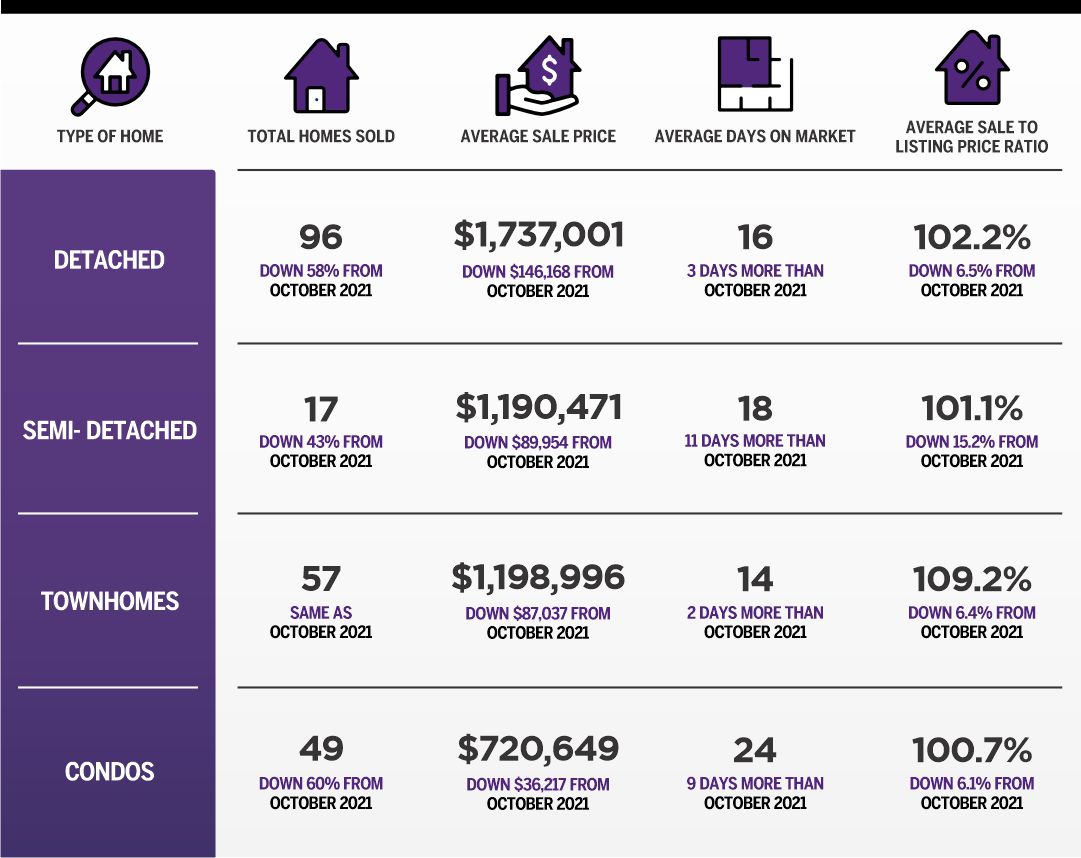

GTA REALTORS® reported 4,961 sales through the Toronto Regional Real Estate Board’s (TRREB) MLS® System in October 2022 – a similar number to September 2022 but down by 49.1 per cent compared to October 2021. Yearover-year sales declines were similar across major market segments.

New listings were down by 11.6 per cent year-over-year and reached an October level not seen since 2010. New listings were down on an annual basis more so for mid-density and high-density home types, which helps to explain why prices have held up better in these categories compared to detached houses.

“With new listings at or near historic lows, a moderate uptick in demand from current levels would result in a noticeable tightening in the resale housing market in short order. Obviously, there is still a lot of short-term economic uncertainty. In the medium-to-long-term, however, the demand for housing will rebound. Public policy initiatives like the recently introduced provincial More Homes Built Faster Act and strong mayor provisions will help ensure we see more homes being built to affordably meet the needs of new households,” said TRREB President Kevin Crigger.

The MLS® Home Price Index (HPI) Composite Benchmark was down by 1.3 per cent year-over-year in October 2022. The average selling price for all home types combined, at $1,089,428, was down by 5.7 per cent compared to October 2021. The monthly trends for both the MLS® HPI Composite and the average selling price have flattened in recent months following steeper declines in the spring and early summer.

“Home prices in the GTA have found support in recent months because price declines in the spring and summer mitigated the impact of higher borrowing costs on average monthly mortgage payments. The Bank of Canada’s most recent messaging suggests that they are reaching the end of their tightening cycle. Bond yields dipped as a result, suggesting that fixed mortgage rates may trend lower moving forward, which would help affordability,” said TRREB Chief Market Analyst Jason Mercer.

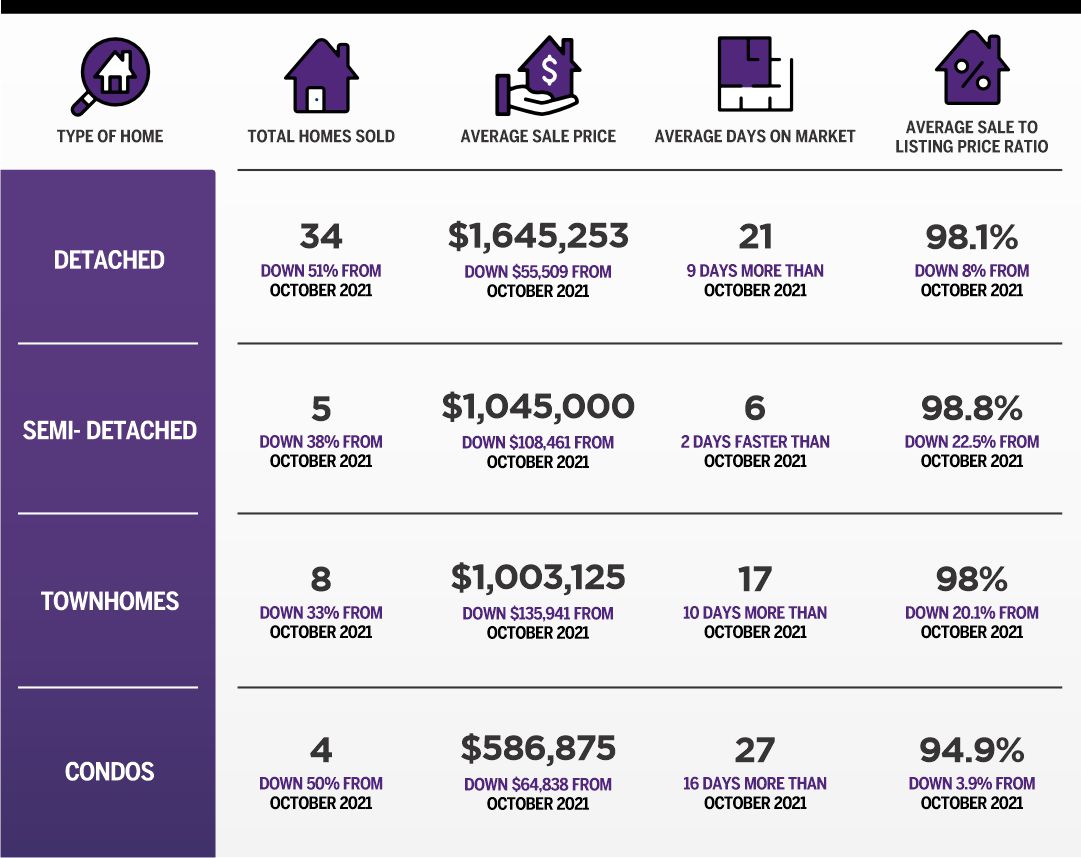

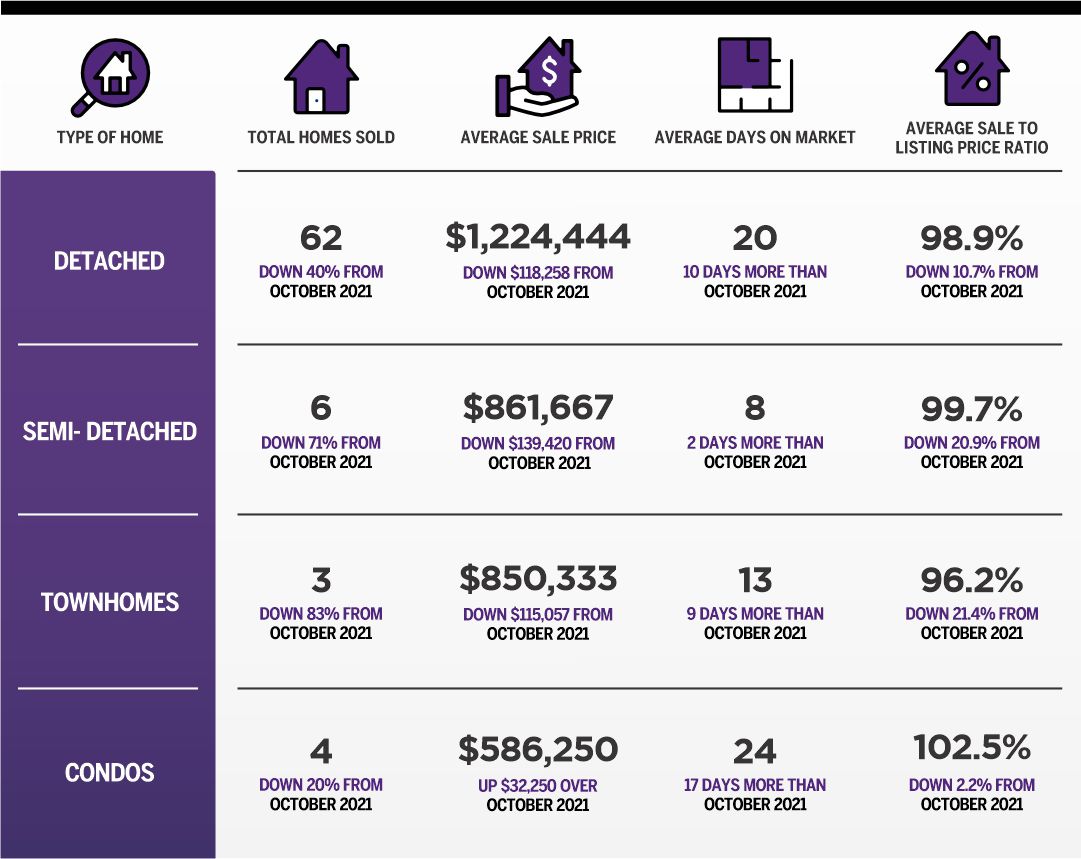

Take a look at the detailed numbers below. If you have any questions about the market, get in touch. We’re here to help guide you through the unique challenges and opportunities presented by this market.

If considering buying or selling give us a call. Our advanced marketing techniques, free home staging, available buyers and uncompromising approach yield consistently excellent results.

June 2021 Market Report

June 2021 Greater Toronto Real Estate Market Report As we passed the mid-point of 2021, home sales were up compared to last year, but are below the March 2021 peak. They were also

May 2021 Market Report

May 2021 Greater Toronto Real Estate Market Report The market has been incredibly strong this year and May was no exception. Along with it being a record breaking month for our team, the

April 2021 Market Report

April 2021 Greater Toronto Real Estate Market Report As we approach the summer, the market is showing continued strength. Month-over-month gains are down slightly, but they're still excellent. There's also continued growth in

How Can We Help You?

Whether you’re looking for your first home, your dream home or would like to sell, we’d love to work with you! Fill out the form below and a member of our team will be in touch within 24 hours to discuss your real estate needs.

Dave Elfassy, Broker

PHONE: 416.899.1199 | EMAIL: [email protected]

Sutt on Group-Admiral Realty Inc., Brokerage

on Group-Admiral Realty Inc., Brokerage

1206 Centre Street

Thornhill, ON

L4J 3M9

Read Our Reviews!

What does it mean to be 1NVALUABLE? It means we’ve got your back. We understand the trust that you’ve placed in us. That’s why we’ll do everything we can to protect your interests–fiercely and without compromise. We’ll work tirelessly to deliver the best possible outcome for you and your family, because we understand what “home” means to you.